SignalFire backs Stampli’s $61 million Series D to modernize accounts payable

No one will mourn the loss of the bureaucracy and paperwork. Across nearly every type of business, finance teams struggle with efficiently handling invoices and accounts payable. It’s the core of their spend and at the root of functions like spend optimization and business intelligence. Yet the function is saddled with outdated software unequipped with AI, so they’re left doing things slowly with too much room for human error. They need a way to eliminate the busywork.That’s why we’re tripling down on Stampli, the AI-powered accounts payable automation and invoice management platform. After leading its Series A in 2018 and Series B, we’re honored to invest alongside Blackstone, which is leading its new $61 million Series D. Read more about it in Bloomberg.

Unlocking efficiency at the heart of every business

Stampli is proving how AI is successfully modernizing one of the most critical financial functions. CFOs are understandably cautious about adopting AI given the unpredictable results of LLMs like ChatGPT and creative tools like Midjourney. There’s no room for errors or hallucinations in the office of the CFO. But thanks to the quantitative scaffolding around finance, clean and controlled training data, and a precise set of well-tested use cases, Stampli can safely streamline and optimize accounts payable. It handles invoice capture, expense allocation, approval routing, fraud detection, and all AP communication without messing up a customer’s existing Enterprise Resource Planning stack.

|

What’s even more exciting is what that unlocks. Stampli can automatically manage the payments workflow reducing manual processes and errors. Through pattern analysis, anonymized benchmarking, and data on external expenses via the Stampli corporate credit card, its AI can produce remarkable business intelligence insights. What are this department’s costs relative to others in my company? Are there opportunities for collaborative buying with subsidiaries? Which types of my invoices are moving the slowest? In a difficult capital market, you can’t always earn more, but Stampli’s intelligence can help you spend less.The company selected Blackstone due to its deep understanding of procurement as a pioneer in private equity that built a centralized spend platform across its portfolio. Blackstone immediately saw the potential of the Stampli platform to bring state-of-the-art capabilities in managing accounts payable, expense cards, vendor management, and more. And since every vendor could also become a Stampli customer, it’s growing virally through the enterprise world.

SignalFire + Stampli

Partnering with Stampli for the last 5 years has been an opportunity for SignalFire to apply its range of value-adds. We were introduced through Bobby Lent, a managing partner at Hillsven and Co-founder of Ariba, who’s part of our advisor network of esteemed operators that help our companies with their toughest challenges like pricing and growth. We used our Beacon AI data platform and in-house talent team to recruit its CRO and original VP of marketing. Beacon has also provided lead gen lists matching Stampli’s ideal customer profile, complete with contact info to drive sales.

|

What originally drew us to Stampli was the determination of two brothers, fixated on removing the financial inefficiencies they experienced at SAP. Stampli’s CEO Eyal and CTO Ofer Feldman were undaunted by incumbents and eager to adopt new AI technologies. The way they delight in solving customers’ problems has translated into a product people love. With over 1300 customers, over 1 million invoices worth more than $5 billion processed in August alone, and a slew of smart new features in development, Stampli is fast becoming the default for tech-savvy CFOs.

*Portfolio company founders listed above have not received any compensation for this feedback and may or may not have invested in a SignalFire fund. These founders may or may not serve as Affiliate Advisors, Retained Advisors, or consultants to provide their expertise on a formal or ad hoc basis. They are not employed by SignalFire and do not provide investment advisory services to clients on behalf of SignalFire. Please refer to our disclosures page for additional disclosures.

Related posts

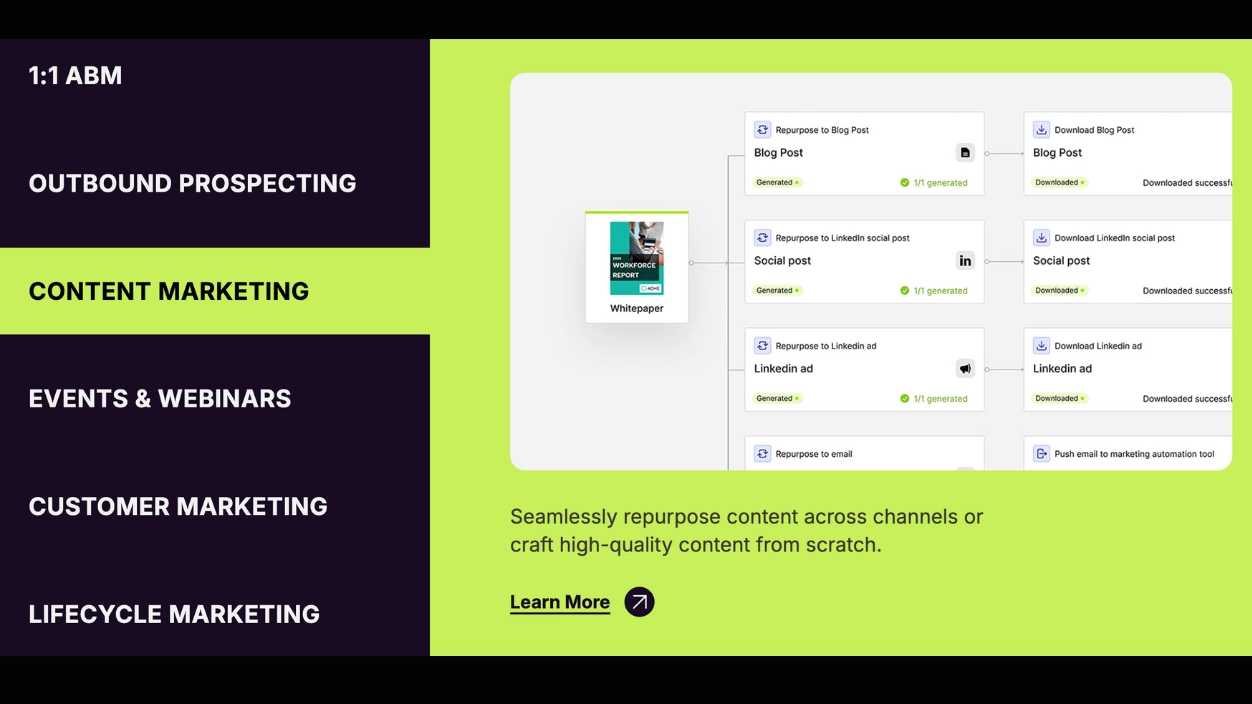

Why we’re continuing to invest in Tofu’s vision - Reducing martech bloat for GTM teams

Justpoint raises $95M to tackle the toxic exposure epidemic with AI